Defined by the ISO, ISO 20022 is “a single standardization approach (methodology, process, repository) to be used by all financial standards initiatives.” It is independent of the organizations and networks that use it. ISO 20022 stands as a comprehensive representation of the business model in the financial services space.

ISO 20022 enables richer, better structured and more granular data end-to-end to be carried in payments messages. More transparency and more remittance information for your customers which in turn means better customer service. And a better customer experience.

Further operational benefits include improved analytics, less manual intervention, more accurate compliance processes, higher resilience and improved fraud prevention measures. A single standard that covers all business domains and end-to-end business processes, ISO 20022 facilitates the creation of new services and enhanced straight-through processing.

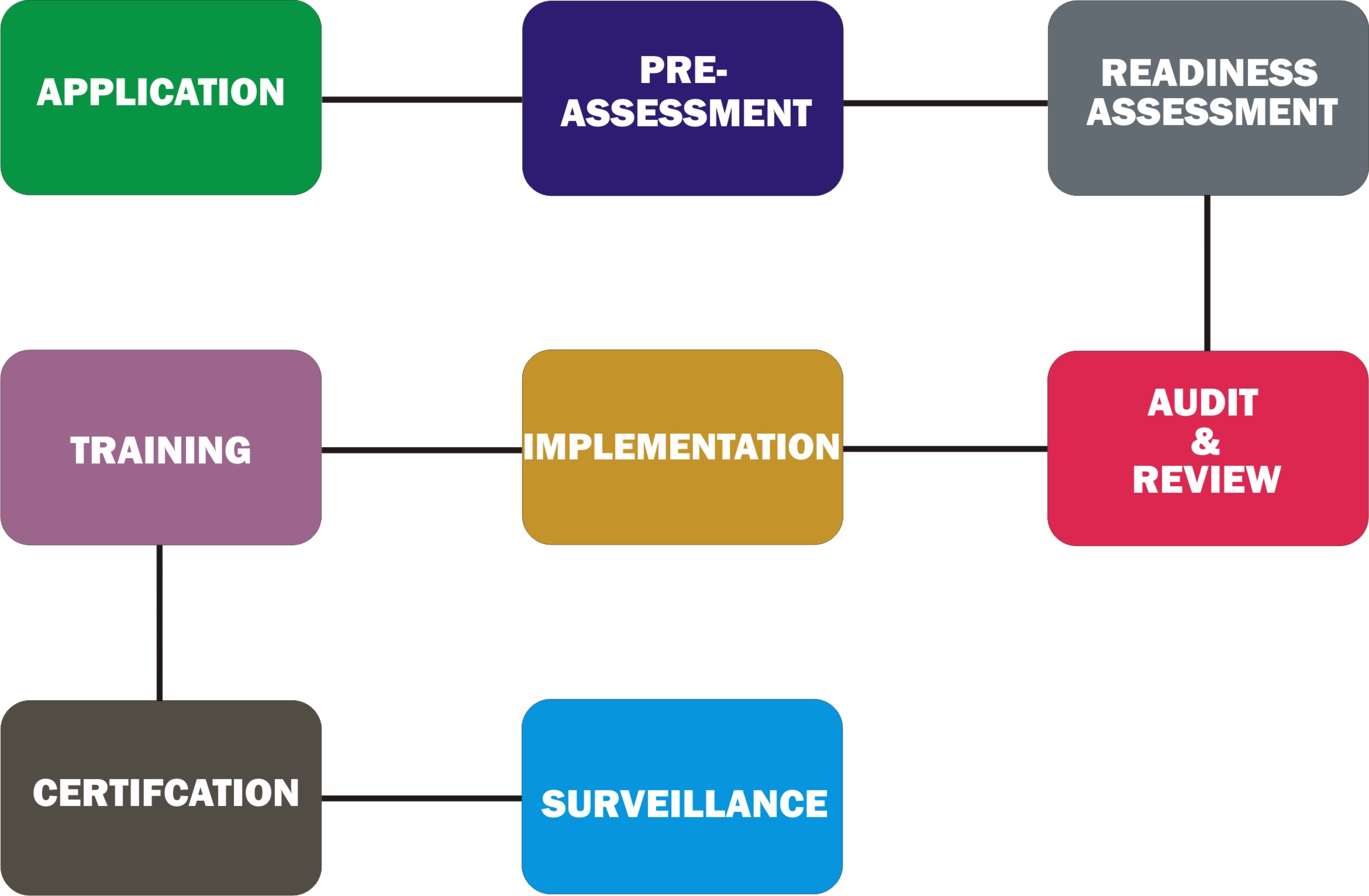

These are some of the items that may be required for the ISO certification process, assessors may require more but your company need to have this basic information ready

Note* - that in case you do now have any of the listed information, our assesors and consultants will work with you to put them in place. You may still go ahead with your application.